Gross hourly wage calculator

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example Lets calculate an example together.

Hourly Rate Calculator

This number is based on 37 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid.

. Federal Income-- --State Income-- --. Net weekly income Hours of work per week Net hourly wage Calculation example Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week. Gross Paycheck --Taxes-- --Details.

A yearly salary of 28000 is 1455 per hour. Tool Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. The PAYE Calculator will auto calculate your saved Main gross salary.

40 regular hours x 20. Net weekly income Hours of work per week Net hourly wage. If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would look as follows.

Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. If you get paid bi. A pay period can be weekly fortnightly or monthly.

Gross Net Calculator 2022 of. Difference between gross pay and net pay. To stop the auto-calculation you will need to delete.

Sara works an average of. Try out the take-home calculator choose the 202223 tax year and see how it affects. Net salary calculator from annual gross income in British Columbia 2022.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

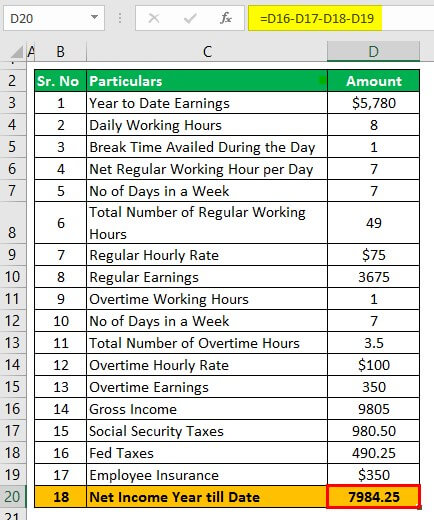

Gross pay is the amount of pay an employee earns before any taxes and deductions are taken out while net pay is the amount an employee. It can be used for the. You can change the calculation by saving a new Main income.

Take for example a salaried. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly To Salary What Is My Annual Income

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Take Home Pay Calculator

Calculating Income Hourly Wage Youtube

3 Ways To Calculate Your Hourly Rate Wikihow

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Gross Pay Youtube

Paycheck Calculator Take Home Pay Calculator

Gross Income Formula Step By Step Calculations

Hourly Paycheck Calculator Step By Step With Examples

Salary To Hourly Salary Converter Salary Hour Calculators